New Research Shows Potential Land Transfer Tax Hike Would Hurt All Buyers and Sellers

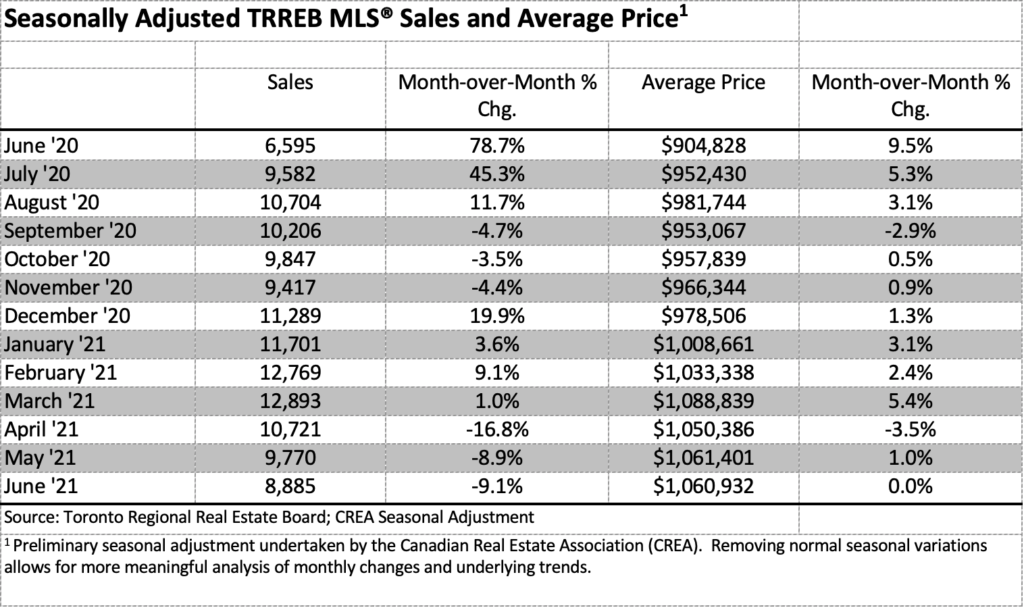

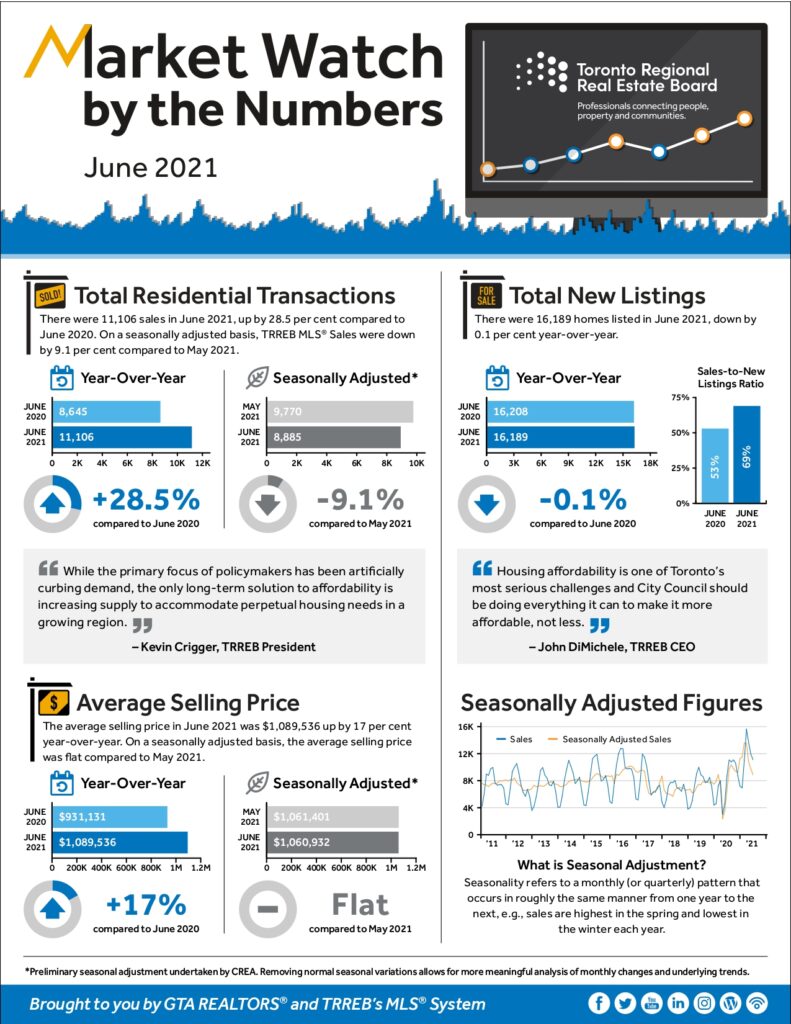

TORONTO, ONTARIO, July 6, 2021 – June home sales were up compared to last year, but remained below the March 2021 peak and were lower than the number of transactions reported for May 2021, consistent with the regular seasonal trend. The average selling price in June increased by double digits compared to last year as well, but the annual rate of increase moderated compared to the previous three months.

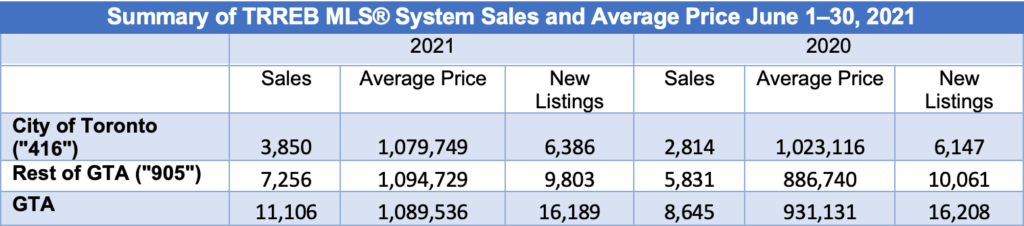

Greater Toronto Area REALTORS® reported 11,106 sales through TRREB’s MLS® System in June 2021 – up by 28.5 per cent compared to June 2020. Looking at the GTA as a whole, year-over-year sales growth was strongest in the condominium apartment segment, both in the City of Toronto and some of the surrounding suburbs. On a month-over-month basis, both actual and seasonally adjusted sales continued to trend lower in June.

“We have seen market activity transition from a record pace to a robust pace over the last three months. While this could provide some relief for home buyers in the near term, a resumption of population growth based on immigration is only months away. While the primary focus of policymakers has been artificially curbing demand, the only long-term solution to affordability is increasing supply to accommodate perpetual housing needs in a growing region,” said TRREB President Kevin Crigger.

In all major market segments, year-over-year growth in sales well outpaced growth in new listings over the same period, pointing to the continuation of tight market conditions characterized by competition between buyers and strong price growth. On a month-over-month basis, both actual and seasonally adjusted average prices edged lower in June.

The June 2021 MLS® Home Price Index composite benchmark was up by 19.9 per cent year over year. The average selling price for all home types combined was up by 17 per cent over the same time period to $1,089,536. While price growth continued to be driven by the low-rise segments of the market, it is important to note that the average condominium apartment price was up by more than eight per cent compared to June 2020, well outstripping inflation.

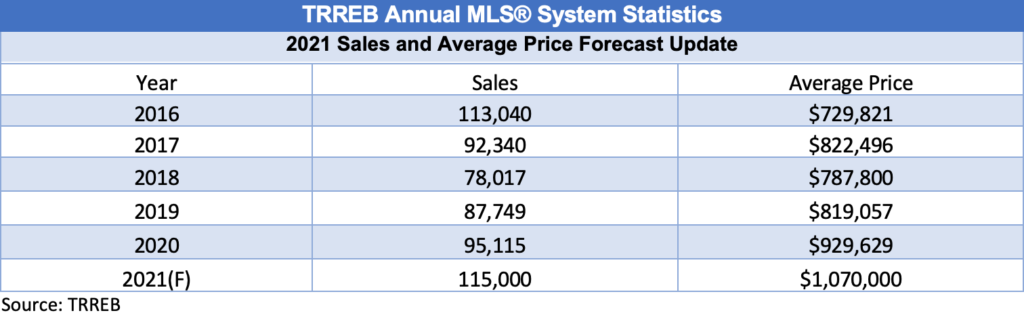

TRREB Forecast Update

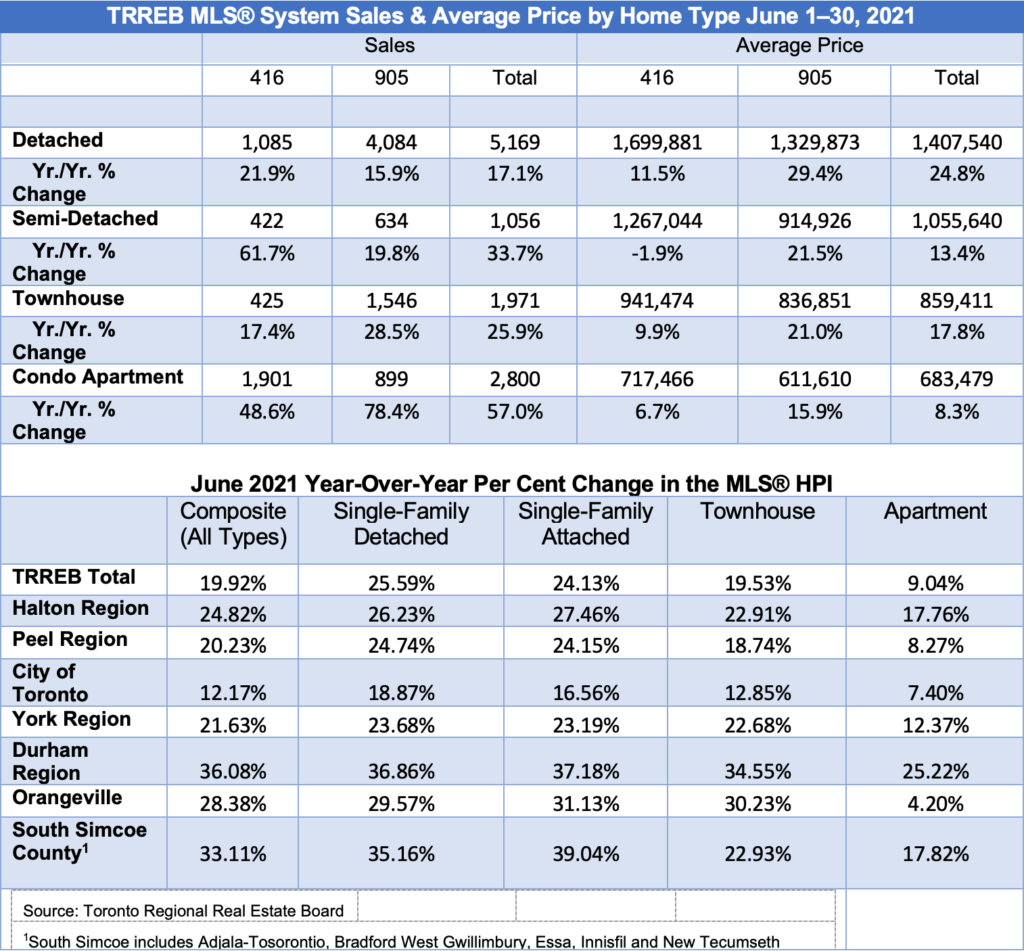

TRREB released its initial forecast for 2021 at the beginning of February in conjunction with its annual Market Year in Review and Outlook report . The outlook for 2021 called for 105,000 transactions reported through TRREB’s MLS® System with an average selling price of $1,025,000.

The reasoning underlying the sales forecast was that an improving regional economy and very low borrowing costs would continue to fuel strong demand, but this demand would ebb somewhat in 2021 because of stalled population growth due to pandemic-related border closures. While sales do appear to have peaked this year and TRREB is no longer reporting record months in terms of home sales, first quarter activity was higher than expected. March home sales, at over 15,000, represented an all-time monthly record.

Taking into account the record Q1 2021 sales result, but still accounting for sales trending below record levels for the remainder of this year, TRREB is revising its 2021 sales forecast upward to 115,000 transactions. With year-over-year sales growth continuing to outpace new listings growth, the forecast average selling price has also been revised upward to $1,070,000.

“Home sales soared at the start of the year, with a huge sales record in the first quarter. However, the record pace of sales has run its course as pent-up demand has increasingly been satisfied in the absence of normal population growth. With this said, a persistent lack of inventory across most segments of the market will keep competition between buyers strong, resulting in an average selling price well above $1 million through the end of 2021,” said TRREB Chief Market Analyst Jason Mercer.

New MLTT Research

TRREB’s market update comes as new public opinion polling, conducted by Ipsos Public Affairs for TRREB, found public opposition to a potential increase in Toronto’s Municipal Land Transfer Tax. Last winter, City of Toronto Council directed City staff to report back in July regarding a possible increase to the land transfer tax for properties priced over $2 million.

“Any MLTT increase has a ripple effect on ALL market segments, and would further constrain inventory, making it an even more challenging environment for buyers. Recent polling by Ipsos shows a majority of residents understand this risk and more than half oppose a potential increase to the land transfer tax. Housing affordability is one of Toronto’s most serious challenges and City Council should be doing everything it can to make it more affordable, not less,” said TRREB CEO John DiMichele.

The poll found more than half of respondents are against this potential MLTT hike. The online poll surveyed 801 Toronto residents, between June 15 and 21 (with a margin of error of +/- 3.9 per cent), and showed:

- 54 per cent oppose a potential MLTT increase on $2 million plus properties

- 63 per cent believe a potential MLTT increase on $2 million plus properties will result in a tighter supply of homes for sale across all price points

Toronto Vacant Home Tax

The City of Toronto is also moving towards implementing a tax on vacant homes, excluding principal residences. TRREB has worked closely with City staff in recent months and years, calling for evidence-based decision making to ensure that the tax meets its policy objectives of improving rental housing supply and ensuring that appropriate exemptions are provided.

“We appreciated the opportunity for input, and we are encouraged that the recommended tax design is consistent with TRREB’s views, especially the need for various exemptions. TRREB is generally supportive of the list of exemptions included in the staff recommendations, and we look forward to providing further input as staff continues with the next step of public consultations,” added DiMichele.

FOR THE FULL REPORT CLICK HERE .

Media Inquiries:

Genevieve Grant, Public Affairs Specialist [email protected] 416-443-8159

The Toronto Regional Real Estate Board is Canada’s largest real estate board with more than 62,000 residential and commercial professionals connecting people, property and communities.

The post TRREB Updates Its Sales Forecast and Average List Price Upwards appeared first on TRREB Wire .