TREB MARKET YEAR IN REVIEW & OUTLOOK 2019 ECONOMIC SUMMIT – DURHAM REGION

TORONTO, February 15, 2019 – Toronto Real Estate Board President Garry Bhaura announced TREB’s Economic Summit for Durham Region, in conjunction with TREB’s fourth annual Market Year in Review and Outlook report. This event consists of multiple presentations concerned with the housing market and broader economy.

This year’s Market Year in Review and Outlook report follows a volatile year for the housing market in 2018. For the GTA as a whole, moderate improvement in terms of sales and average selling price is expected for 2019.

“Although we won’t experience record levels, we do expect to see a better year in 2019 for sales and selling prices reported by GTA REALTORS® through TREB’s MLS® System. Many buyers who moved to the sidelines over the past year due to various government policies, including the OSFI-mandated mortgage stress test, have re-evaluated their positioning in the marketplace vis-à-vis home type, location and price point. It makes sense that Ipsos, in its Home Buyers Survey conducted for TREB, found that the share of intending home buyers has increased,” said Mr. Bhaura.

“Even though we’re seeing positive government action on a number of key housing files, one area that needs to be revisited is the imposition of the OSFI-mandated two percentage point mortgage stress test. While we saw buyers return to the market in the second half of 2018, we have to have an honest discussion on whether or not today’s home buyers are being stress tested against rates that are realistic. Home sales in the GTA, and Canada more broadly, play a huge role in economic growth, job creation and government revenues every year. Looking through this lens, policymakers need to be aware of unintended consequences the stress test could have on the housing market and broader economy,” said John DiMichele, TREB CEO.

Durham Region Summary

The following points summarize market conditions in Durham Region with TREB’s overall outlook for the GTA as a backdrop:

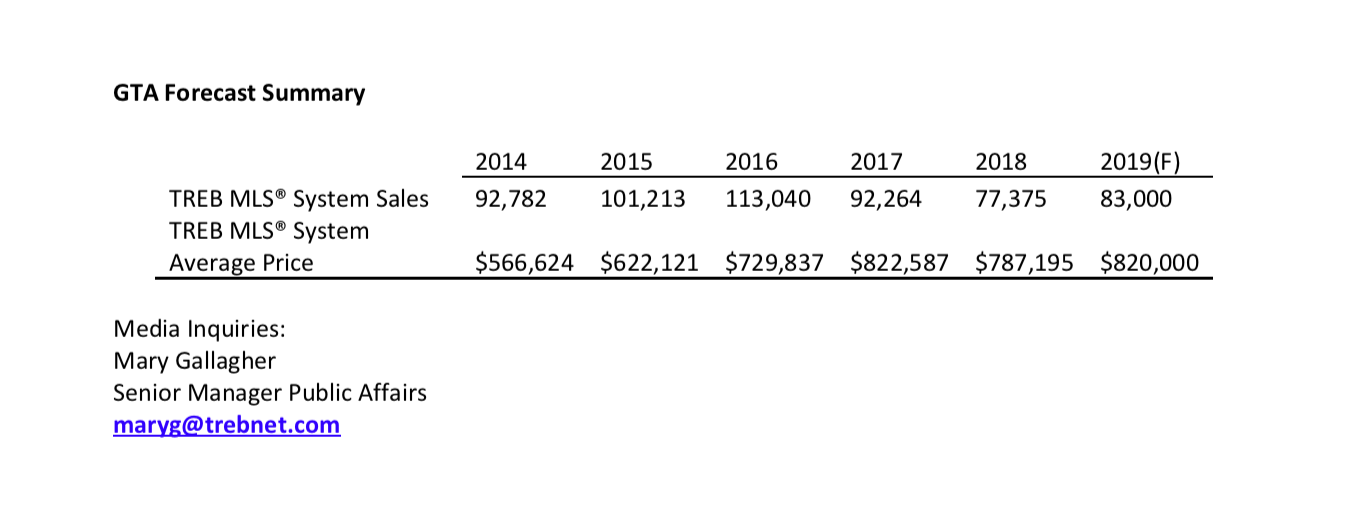

- For the TREB market area as a whole, 83,000 sales are forecast to be reported through TREB’s MLS® System in 2019 – a moderate increase compared to 77,375 sales in 2018. TREB does not produce a specific sales forecast for Durham region, but Durham sales have accounted for approximately 11.5 per cent of total sales within TREB’s market area over the past decade.

- Slightly tighter market conditions, similar to those observed in the second half of 2018, will support a moderate pace of price growth in 2019. The average selling price for TREB’s market area as a whole will increase to $820,000 – close to the peak reached in 2017 and up from an average of $787,195 in 2018. In Durham Region, home prices have historically been driven by the detached market segment. Price growth for the detached market segment was below average over the past year.

- Ipsos results confirm that the OSFI-mandated mortgage stress test has negatively impacted affordability. TREB analysis found that, on average, GTA home buyers had to qualify for monthly mortgage payments almost $700 above what they will actually pay in 2018. In Durham Region, for low-rise home types, buyers would have to qualify for payments $400 to $600 dollars more than they would actually pay on average, depending on home type. In order to account for the higher qualification standard, the Ipsos Home Buyers survey found that many intending home buyers in Durham have adjusted their preferences, including their purchase price point and type of home they intend on purchasing.

- The Ipsos Home Buyers survey found that the share of respondents in the ‘905’ area code regions of the GTA indicating that they were at least somewhat likely to purchase a home in the next year edged up to 26 per cent compared to 25 per cent a year earlier. This share was slightly lower in Durham Region, at 20 per cent.

- The Ipsos Home Buyers survey found that the share of first-time home buyers at least somewhat likely to purchase a home in the next year has trended lower in the ‘905’ area code regions of the GTA, to 32 per cent compared to 37 per cent last year. The likely first-time buyer share in Durham Region was 29 per cent.

- Over the last decade, the number of new listings entered into TREB’s MLS® System has trended flat to downward, notwithstanding a brief spike in 2017. Results from the Ipsos Home Owners survey suggest that the flat to downward trend in the GTA could continue in 2019. Listing intentions were similar to last year, with 37 per cent of surveyed home owners in the ‘905’ area code regions indicating that they are at least somewhat likely to list their home for sale over the next year compared to 38 per cent last year. In Durham Region, listing intentions were at 29 per cent for the next year.“Despite some uncertainty regarding economic growth over the next year, many traditional housing market drivers remain in place. The GTA population will continue to grow over the next year, as people are attracted to the GTA by the region’s diversity of job opportunities. Unemployment is expected to remain very low and home buyers are expected to benefit from lower fixed mortgage rates, on average, compared to 2018,” said Jason Mercer, TREB’s Director of Market Analysis and Service Channels.“Ipsos surveys consistently find housing to be top of mind for Canadians. In the fourth quarter of 2018, housing was ranked as the third most important issue Canada-wide and second most important issue in Ontario. This suggests that housing policy should also be top of mind for both the relatively new provincial government in Ontario and federal party leaders who have an election on the near horizon,” said Sean Simpson, Vice President at Ipsos.

Cutting Edge Research on Housing Supply

This year’s report envisions housing options and supply for liveable communities and puts the focus on how transit-supportive development and the creation of more “missing middle” (townhouses, row houses, duplexes, etc.) might offset housing affordability issues seen throughout the Region. In addition to contributions on these topics from the Pembina Institute and Ryerson University’s Centre for Urban Policy and Land Development, respectively, TREB also garnered submissions from several regional policymakers, including Mayors John Tory and Bonnie Crombie.

“Transit-supportive development is a key strategy for cities to build vibrant and compact communities within walking distance from transit – places with a balanced mix of housing, jobs, and shopping. Intensification around GO stations can help the GTHA strategically increase housing supply and choice and help individuals and families reduce their housing and transportation costs. GO stations and lands surrounding it are a significant public asset, so let’s not miss out on the opportunities that allow people to access more housing options, live active lifestyles, and access transit close to where they live,” Carolyn Kim, Director, City Building, Pembina Institute.

The Pembina Institute’s research for TREB examines two real life case studies in the Greater Golden Horseshoe and shows that housing built within a ten minute walk of a transit station, and in areas that feature a balanced mix of housing, jobs, shopping and services, can result in potential housing and transportation savings ranging from 10 to 56 per cent for individuals, families and retirees.

“The lack of supply of missing middle housing in Toronto is due to a few key factors that fall into the hands of municipal policy makers. It is up to the Council of the City of Toronto to loosen supply-side constraints so the city can offer people what they want – affordable, missing middle housing,” Frank Clayton, Senior Research Fellow, Centre for Urban Policy and Land Development, Ryerson University.

The Ryerson University Centre’s research for TREB offers some workable ideas on how to create more missing middle housing, which could fill the gaps in the types of homes needed and positively impact affordability. Currently, only 25 per cent of the City’s housing stock is missing middle housing (commonly defined as townhouses, row houses, duplexes, etc). Building more of this type of housing could provide more affordable family friendly options resulting in savings ranging from 20 to 49 per cent in the average price of housing according to the Centre’s research. The study goes on to conclude that if Toronto’s predominantly single detached neighbourhoods were opened up to missing middle construction, it could add over 200,000 units over a 30-year period.

Altus Data Solutions provided up-to-date statistics and analysis on the new home and residential land markets in the GTA, providing insight into new housing supply that came online in 2018 and what is in the pipeline moving forward.

TREB is Canada’s largest real estate board. Over 53,000 residential and commercial TREB Members serve consumers in the Greater Toronto Area. Greater Toronto REALTORS® are passionate about their work. They are governed by a strict Code of Ethics and share a state-of-the-art Multiple Listing Service®.

The post TREB Market Year in Review & Outlook 2019 Economic Summit in Durham appeared first on TREB Wire .