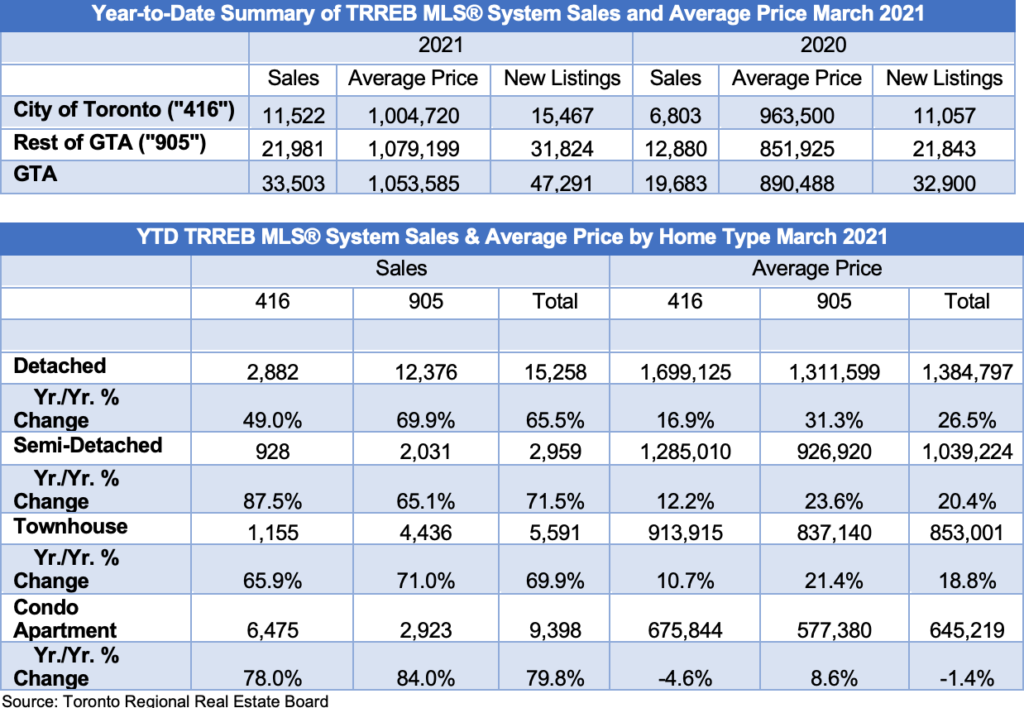

TORONTO, ONTARIO, April 6, 2021 – For the third straight month of 2021, record home sales continued in March across the Greater Toronto Area (GTA) with buyers taking advantage of favourable borrowing costs and continued improvement in many sectors of the economy.

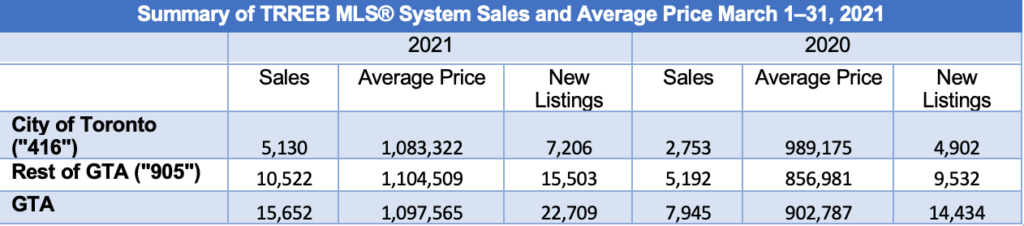

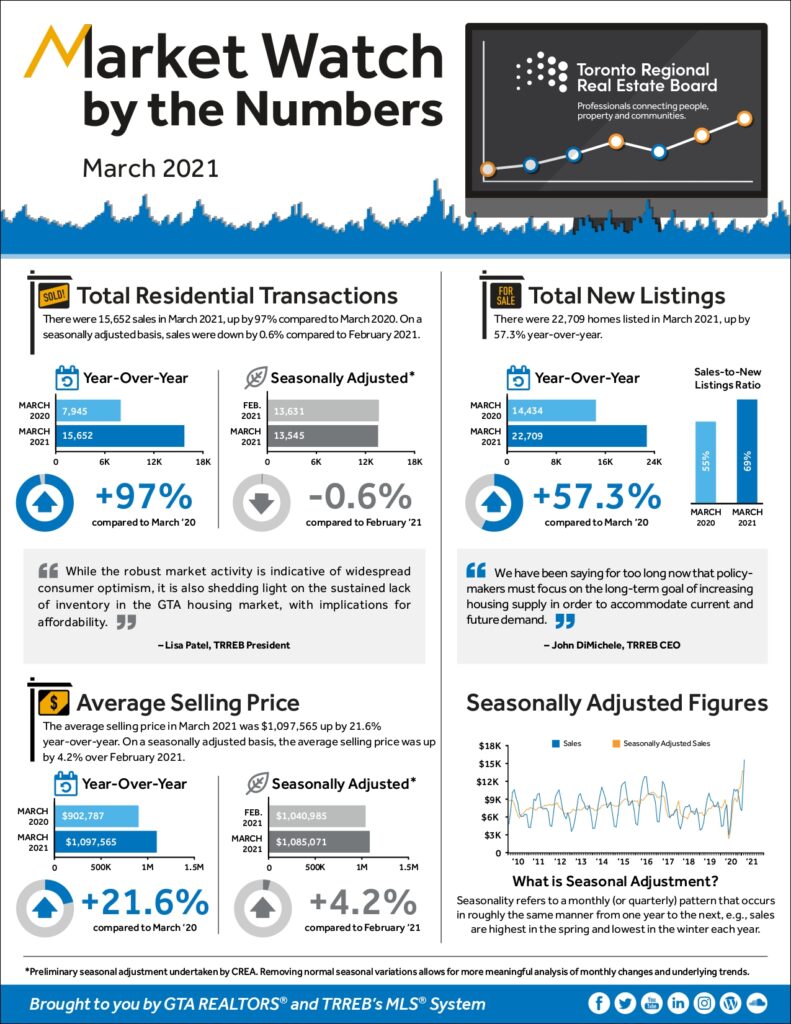

GTA REALTORS® reported 15,652 sales in March 2021 – close to double that of March 2020. While sales were strong, it is important to remember that for the second half of March 2021, we are comparing against the initial impact of COVID-19 in the second half of March 2020 when sales activity dropped off dramatically. With this in mind, it is important to consider annual sales growth for the pre-COVID period (March 1 to 14, 2020) and the COVID period (March 15 to 31, 2020):

- There were 6,504 sales reported during the first 14 days of March 2021 – up 41 per cent compared to the pre-COVID period in March 2020.

- There were 9,148 sales reported between March 15 and March 31, 2021, an increase of 174 per cent compared to the COVID period of March 2020. This is a stark reminder of the initial impact COVID-19 had on the housing market and overall economy a year ago.

“Confidence in economic recovery coupled with low borrowing costs supported a record pace of home sales last month. While the robust market activity is indicative of widespread consumer optimism, it is also shedding light on the sustained lack of inventory in the GTA housing market, with implications for affordability,” said TRREB President Lisa Patel.

For March 2021 as a whole, new listings were up 57 per cent year-over-year to 22,709. While representing a strong year-over-year increase, the annual growth rate for new listings was well-below that of sales.

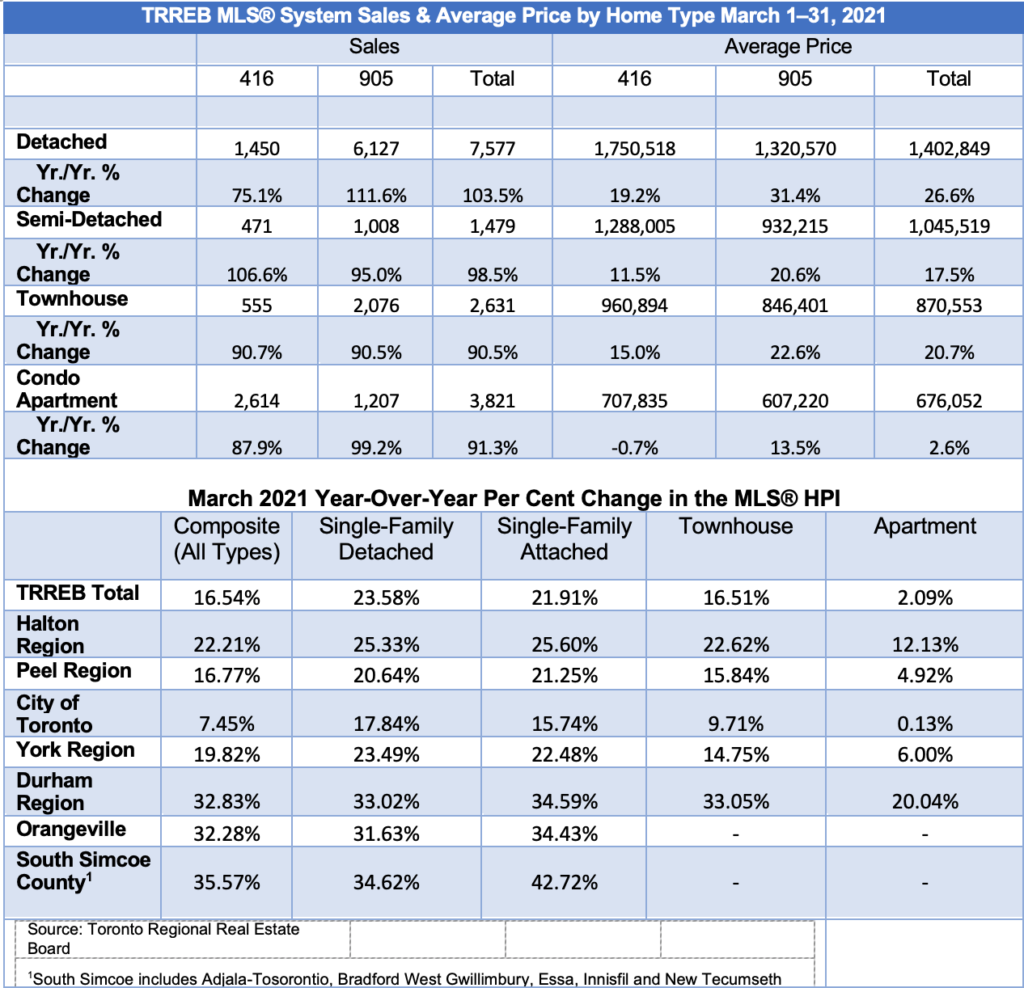

“With sales growth outstripping listings growth by a large margin, including in the condo market segment, competition between buyers in some market segments and the potential for double-digit price growth could continue without a meaningful increase in the supply of homes available for sale. This will become more apparent as population growth resumes over the next year,” stressed TRREB Chief Market Analyst Jason Mercer.

The MLS® Home Price Index Composite Benchmark for March 2021 was up by 16.5 per cent compared to March 2020. The average selling price at $1,097,565 was up by 21.6 per cent over the same period. Following the recent trend, low-rise home sales in regions surrounding the City of Toronto drove price growth.

“The current state of the market has reinvigorated discussions about potential demand-side policy interventions. Policies focussed on demand, such as a capital gains tax on primary residences, can have a short-term impact, but can also be fraught with unintended consequences like further stifling the supply of listings. The federal minister responsible for the housing portfolio has said his government will not entertain such a policy option, which is the right decision. We have been saying for too long now that policymakers must focus on the long-term goal of increasing housing supply in order to accommodate current and future demand,” said TRREB CEO John DiMichele.

FOR THE FULL REPORT CLICK HERE

Media Inquiries:

Genevieve Grant, Public Affairs Specialist [email protected] 416-443-8159

The Toronto Regional Real Estate Board is Canada’s largest real estate board with more than 59,000 residential and commercial professionals connecting people, property and communities.

The post Consumer Confidence And Low Interest Rates Drive Up Homes Sales In GTA appeared first on TRREB Wire .